Home Insurance

Home Insurance and Life Insurance Monitor. A place to find good information.

Monday, June 12, 2006

Improve your home security to lower your homeowners insurance costs it's usually a good deal.

You can usually get discounts of at least 5 % for a smoke detector, burglar alarm or dead-bolt locks or 15 or 20 % discounts if you install a sophisticated sprinkler system and a fire and burglar alarm that rings at the police, fire or other monitoring stations.

Always check with your insurance agent any discounts you qualify for, and to see if you can save any more on premiums by installing sophisticated and expensive security equipment. Ask your insurer what it's recommended, how much would cost and how much you'll save.

You can usually get discounts of at least 5 % for a smoke detector, burglar alarm or dead-bolt locks or 15 or 20 % discounts if you install a sophisticated sprinkler system and a fire and burglar alarm that rings at the police, fire or other monitoring stations.

Always check with your insurance agent any discounts you qualify for, and to see if you can save any more on premiums by installing sophisticated and expensive security equipment. Ask your insurer what it's recommended, how much would cost and how much you'll save.

---

$299 - Includes 60 cable and 4 wide angle cameras with microphone and view up to 4 locations simultaneously on a 14-inch monitor

$2,276 - Video motion detection with night vision cameras, Real-time audio and video recording, Remote surveillance, remote playback and remote configuration over the Internet

Tuesday, June 06, 2006

Inflation is a fall in the market value or purchasing power of a money (a general and progressive increase in prices).

This is especially important with a homeowners policy. It may have cost you $100,000 to build your home 10 years ago, but it might cost $120,000 to replace it today. As inflation increases the cost of living rises. Suppose the present rate of inflation is 3%. What that means is that the goods you could buy last year for $100 this year will cost you $103, next year $106, and in ten years time $134.

# Inflation Calculator # uses the average Consumer Price Index for a given calendar year and for the current year it's used the latest monthly index value.

Caused especially by :

- demand is growing faster than supply and prices rise

- when a company’s costs go up it needs to increase prices to maintain its profit margins

Unanticipated inflation means problems. Creditors (lender) lose cash and debtors (borrower) gain money if the lender does not anticipate inflation correctly.

This is especially important with a homeowners policy. It may have cost you $100,000 to build your home 10 years ago, but it might cost $120,000 to replace it today. As inflation increases the cost of living rises. Suppose the present rate of inflation is 3%. What that means is that the goods you could buy last year for $100 this year will cost you $103, next year $106, and in ten years time $134.

# Inflation Calculator # uses the average Consumer Price Index for a given calendar year and for the current year it's used the latest monthly index value.

Caused especially by :

- demand is growing faster than supply and prices rise

- when a company’s costs go up it needs to increase prices to maintain its profit margins

Unanticipated inflation means problems. Creditors (lender) lose cash and debtors (borrower) gain money if the lender does not anticipate inflation correctly.

Monday, June 05, 2006

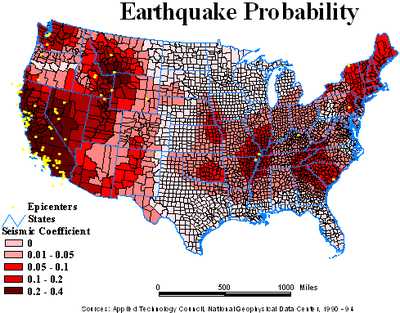

Allstate Insurance Co. says it is dropping earthquake insurance to most of its 407,000 quake customers nationwide as a part of a larger move to reduce exposure to catastrophic losses.Other major companies plan to take similar action (insurance companies are really not in the mood to take on earth fury). Californians are not be affected by this Allstate decision.

Allstate lost $1.55 billion last year because of Hurricane Katrina.

Earthquake insurance covers any damages by earthquakes and also includes landslide, mudslide, mudflow, sinkhole or any other movement that involves the sinking, rising or shifting of earth.

Flood insurance won't go into effect the moment you buy it. There's a 30-day waiting period.

Flood insurance won't go into effect the moment you buy it. There's a 30-day waiting period.It is important to realize that the flood insurance a lender requires, if the home is on a flood plain, covers only the structure.

If you do get flood insurance, it normally comes with a $500 deductible. Your premium will depend on where your house is.

The number of times that a flood claim has been filed on the house is also a factor.

Government-subsidized flood insurance is a wise investment against inundation.

Getting the right home insurance can be pretty hard, so you will find here 5 tips to help you:

1. Take inventory (take pictures of rooms and note all the furnishings and possessions)

2. Understand the lingo (you will likely have chosen a cash value policy, which means that any settlement you get for damaged furniture, clothes and other household goods will be depreciated for wear and tear)

3. Beat inflation (Do not forget about inflation)

4. Protect your valuables (If you have expensive or rare items, get them appraised and look into a separate floater policy)

5. Get flood insurance

1. Take inventory (take pictures of rooms and note all the furnishings and possessions)

2. Understand the lingo (you will likely have chosen a cash value policy, which means that any settlement you get for damaged furniture, clothes and other household goods will be depreciated for wear and tear)

3. Beat inflation (Do not forget about inflation)

4. Protect your valuables (If you have expensive or rare items, get them appraised and look into a separate floater policy)

5. Get flood insurance

Friday, June 02, 2006

First we start with home insurance definition:

Home insurance = homeowners insurance, is an insurance policy (equitable transfer of the risk of a potential loss, from one entity to another, in exchange for a premium and duty of care) that combines insurance on the home, its contents, and, often, the other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home.

The cost of homeowners insurance scales upward depending on what it would cost to replace the house, and which additional "riders", meaning additional items to be insured, are attached to the policy. The insurance policy itself is a lengthy contract, and names what will and what will not be paid in the case of various events. Typically, claims are not paid due to earthquakes (shaking of the ground), floods, "Acts of God", or war (whose definition typically includes a nuclear explosion from any source). Special insurance can be purchased for these possibilities.

"Acts of God" like Katrina hurricane

Home insurance = homeowners insurance, is an insurance policy (equitable transfer of the risk of a potential loss, from one entity to another, in exchange for a premium and duty of care) that combines insurance on the home, its contents, and, often, the other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home.

The cost of homeowners insurance scales upward depending on what it would cost to replace the house, and which additional "riders", meaning additional items to be insured, are attached to the policy. The insurance policy itself is a lengthy contract, and names what will and what will not be paid in the case of various events. Typically, claims are not paid due to earthquakes (shaking of the ground), floods, "Acts of God", or war (whose definition typically includes a nuclear explosion from any source). Special insurance can be purchased for these possibilities.

"Acts of God" like Katrina hurricane

Previous posts

Affordable Insurance Quotes To Save You Money!Bogus home insurance claim

Home insurance is needed everywhere

Life insurance for kids

Enough insurance coverage for your home

Tip: Live-In house keeper

Tip : Non-smokers and early retiree dicounts

Tip for home insurance discounts

Why Inflation is Important

Earthquake insurance